Decoding Government Revenue, Expenditure, and Accountability

Public finance, governance challenges, and economic outcomes for a sustainable future.

Working in academia for about a decade, I came to understand that both faculty and students often take their funding sources for granted. Hoping for a change, I moved to the industry, expecting a different perspective. While there were some differences, they were limited to a smaller scale. On a larger scale, the similarities were striking, particularly in their efforts to evade taxes

Academia and industry, it seemed, were two sides of the same coin.

Academics frequently blamed the government for insufficient funding or for taxing research consumables. Similarly, industries and their employees pointed fingers at the government for high taxes.

In both spheres, the underlying narrative was consistent: the government was responsible for their struggles.

This begs the question: Are either of them correct? If so, who is right, and why?

Answering these questions requires a holistic understanding of how governments generate revenue, allocate expenditure, and manage the economy.

My goal here is to equip readers—especially laypersons—with the fundamental knowledge to critically evaluate their governments and support the collective well-being of humanity.

In the rest of this article, I focus on fostering this understanding by dividing the article into the following sections:

Source of government revenue (or) How does the government make its money?

Areas of government expenditure (or) Where does the government spend this money?

Metrics to understand a country’s economic health (or) How to evaluate a country’s economy?

Defining good governance (or) What constitutes good governance?

Understanding classic performance issues (or) What are the routine issues causing poor performance of a government?

Fixing performance issues (or) How can we resolve the issues discussed?

1. Sources of government revenue (or) How does the government make its money?

Let’s begin by understanding the government’s sources of money.

A government formed in any country benefits from money or revenue from some or all of the following measures.

Taxes: The public pays taxes to the government as individuals and organizations. This includes all forms of taxes (income, property, corporate, capital gains, goods and services, sales, etc.)

Fees or Charges: Governments charge for a wide range of services, like licenses (driver’s, business, fishing, etc.), parking permits, passport applications, public record access, and national level examinations/job applications.

Fines and Penalties: Fines from traffic violations, environmental infractions, and other legal penalties contribute to government revenue.

Loans and Bonds: Governments issue bonds (debt securities) to raise capital from investors. These bonds will be repaid with interest but provide immediate funds for large government projects.

Dividends from State-Owned Enterprises: If the government owns stakes in profitable businesses, such as utilities, railways, or oil companies, they can earn dividends and profits.

Natural Resources: Governments can make significant income by leasing, selling, or managing natural resources like oil, gas, minerals, and timber.

Lottery and Gambling Revenue: Many governments run or tax lotteries, casinos, and other gambling establishments, using a portion of these revenues for public funding.

Tariffs and Customs Duties: Import and export tariffs on goods crossing borders provide income while regulating trade.

Foreign Aid and Grants: Some governments receive aid, grants, or loans from other nations or international organizations like the World Bank, especially for development and infrastructure projects.

Investments and Sovereign Wealth Funds: Governments often invest in various assets, including real estate, stocks, and international assets. Some countries establish sovereign wealth funds to manage these investments and generate long-term returns.

Licensing and Leasing Public Assets: Governments may lease public lands, airports, highways, or other infrastructure to private companies for a fee.

2. Areas of government expenditure (or) Where the government spends its money?

Now that we know how the government makes money, let’s discuss how/where the government spends this money. Below is a comprehensive list of areas where the government invests this money for society to benefit.

1. Social Services

Healthcare

Public hospitals and clinics

Universal healthcare programs

Disease prevention and vaccination campaigns

Mental health services

Subsidized prescription drugs

Education

Public schools, colleges, and universities

Teacher salaries and training

Student loans and scholarships

Research and development in education

Social Welfare

Pensions and retirement benefits

Unemployment benefits

Disability support and rehabilitation

Child welfare programs and foster care

Housing assistance and public housing projects

Food and Nutrition

Food stamps and nutritional aid programs

School meal programs

Subsidized agricultural products

Public Safety Net

Emergency relief funds

Disaster response and recovery efforts

2. Infrastructure and Development

Transportation

Roads, bridges, and highways

Public transit systems (buses, trains, subways)

Airports and ports

Utilities

Water supply and sanitation systems

Electricity grid maintenance and renewable energy initiatives

Telecommunications infrastructure

Urban Development

Smart cities and urban planning

Affordable housing projects

Parks, recreational areas, and public spaces

3. Defense and Security

Military

Armed forces personnel and equipment

Defense technology and research

Border security and surveillance

Law Enforcement

Police forces and training

Criminal investigation agencies

Forensic laboratories

Emergency Services

Fire departments

Ambulance services

Disaster preparedness and response units

Cybersecurity

National cybersecurity programs

Data protection measures

Counter-terrorism technology

4. Governance and Administration

Government Operations

Salaries for civil servants and elected officials

Public buildings maintenance

Legislative and judicial expenses

Elections

Electoral commissions and election monitoring

Voter education and registration

International Relations

Embassies and consulates

Diplomatic missions and summits

Contributions to international organizations (e.g., UN, WHO)

5. Economic Development

Agriculture

Subsidies for farmers

Irrigation projects

Rural development programs

Industry and Trade

Support for small and medium enterprises (SMEs)

Export promotion initiatives

Industrial parks and special economic zones

Employment Programs

Job creation initiatives

Skill development and vocational training

Research and Innovation

Funding for scientific research

Support for startups and tech innovation

6. Environmental and Energy Programs

Environmental Protection

Conservation of forests and wildlife

Pollution control and waste management

Climate change mitigation and adaptation

Energy

Renewable energy projects (solar, wind, hydro)

Subsidies for clean energy technologies

Fossil fuel subsidies (in some countries)

Water and Land Management

Dams and irrigation systems

Soil conservation projects

7. Debt and Financial Obligations

Public Debt Servicing

Interest payments on national debt

Repayment of principal on loans

Contingency Funds

Emergency reserves for economic crises

Disaster relief and recovery funds

8. Cultural, Recreational, and Historical Programs

Arts and Culture

National museums, galleries, and libraries

Performing arts and cultural festivals

Grants for artists and cultural organizations

Sports

Stadiums and sports facilities

Funding for national teams and sports events

Heritage Conservation

Preservation of historical monuments

Archaeological research

Cultural heritage management

9. Science, Technology, and Space Exploration

Space programs (e.g., NASA, ESA)

Development of artificial intelligence and robotics

Medical and pharmaceutical research

Geological surveys and exploration

10. Miscellaneous Expenditures

Subsidies

For industries like oil, gas, and coal

Public transportation systems

Public Broadcasting

National TV and radio channels

Foreign Aid

Humanitarian assistance to other countries

Contributions to global development programs

This list highlights the breadth of government spending, showing how deeply governments are involved in various aspects of national and international life.

Having discussed the government’s sources of revenue and its areas of expenditure, we can better understand a country’s economic health.

3. Metrics to understand a country’s economic health (or) How to evaluate a country’s economy?

A country’s economic health is typically gauged using various metrics. It involves analyzing multiple metrics that provide a comprehensive view of economic health, growth, and stability. These metrics include:

1. Macroeconomic Metrics

Gross Domestic Product (GDP): The total value of goods and services produced in a country, often analyzed as:

Nominal GDP: Measured at current market prices.

Real GDP: Adjusted for inflation.

GDP Per Capita: GDP divided by the population, indicating average economic output per person.

Gross National Income (GNI): Includes GDP plus income earned abroad.

Unemployment Rate: percentage of the labor force that is jobless and actively seeking work.

Inflation Rate: The rate at which prices for goods and services rise, measured using indices like the Consumer Price Index (CPI) or Producer Price Index (PPI).

Balance of Trade: The difference between exports and imports, indicating trade surplus or deficit.

2. Financial and Monetary Metrics

Currency Stability: The strength and volatility of the national currency.

Interest Rates: Set by the central bank, influencing borrowing and investment.

Government Debt-to-GDP Ratio: A measure of fiscal health and sustainability.

Foreign Exchange Reserves: The amount of foreign currency held by the central bank.

3. Social and Developmental Metrics

Poverty Rate: Percentage of the population living below the poverty line.

Income Inequality: Measured by the Gini coefficient.

Human Development Index (HDI): Composite index of life expectancy, education, and per capita income.

Labor Force Participation Rate: Percentage of the working-age population that is employed or seeking employment.

4. Sector-Specific Metrics

Industrial Production Index: Measures output in manufacturing, mining, and utilities.

Agricultural Output: Contribution of agriculture to GDP.

Service Sector Growth: Contribution of services like IT, banking, and healthcare to the economy.

5. External and Global Metrics

Foreign Direct Investment (FDI): Inflows of investment from other countries.

Trade Openness: The sum of exports and imports as a percentage of GDP.

Global Competitiveness Index (GCI): Measures productivity and competitiveness across countries.

6. Quality-of-Life and Sustainability Metrics

Environmental Performance Index (EPI): Measures sustainability and environmental health.

Happiness Index: Assesses well-being beyond economic factors.

Access to Infrastructure: Availability of essential services like electricity, water, and internet.

7. Innovation and Productivity Metrics

Total Factor Productivity (TFP): Measures efficiency in using labor and capital.

Research and Development (R&D) Spending: Investment in innovation as a percentage of GDP.

8. Regional and Demographic Metrics

Urbanization Rate: Proportion of the population living in urban areas.

Age Dependency Ratio: Ratio of dependents (young and old) to the working-age population.

These metrics are often used in combination to evaluate a country’s economic performance and inform policy-making.

4. Defining good governance (or) What constitutes good governance?

The best way to identify good governance is by assessing whether government investments have led to positive changes in most of the metrics outlined above.

However, addressing all these metrics simultaneously is an extremely challenging task for any government. This is why GDP often takes precedence—it is a metric that is easier to discuss and more frequently makes headlines than the others.

Frankly, this focus on GDP isn’t entirely misplaced. An increase in GDP serves as the simplest indicator of an economy's growth or performance. It demonstrates that government spending has significantly enhanced the nation's productive capacity. GDP per capita, in particular, provides a better measure of how government expenditure has improved the productivity of individual citizens.

Why is an increase in GDP important for the government?

For a government investing in the nation's development and its people, an increase in GDP reflects the success of its efforts. Additionally, for the same tax brackets, higher GDP translates into increased tax revenue. This provides the government with more resources to invest back into the economy and further improve people's lives.

How does this improve people's lives?

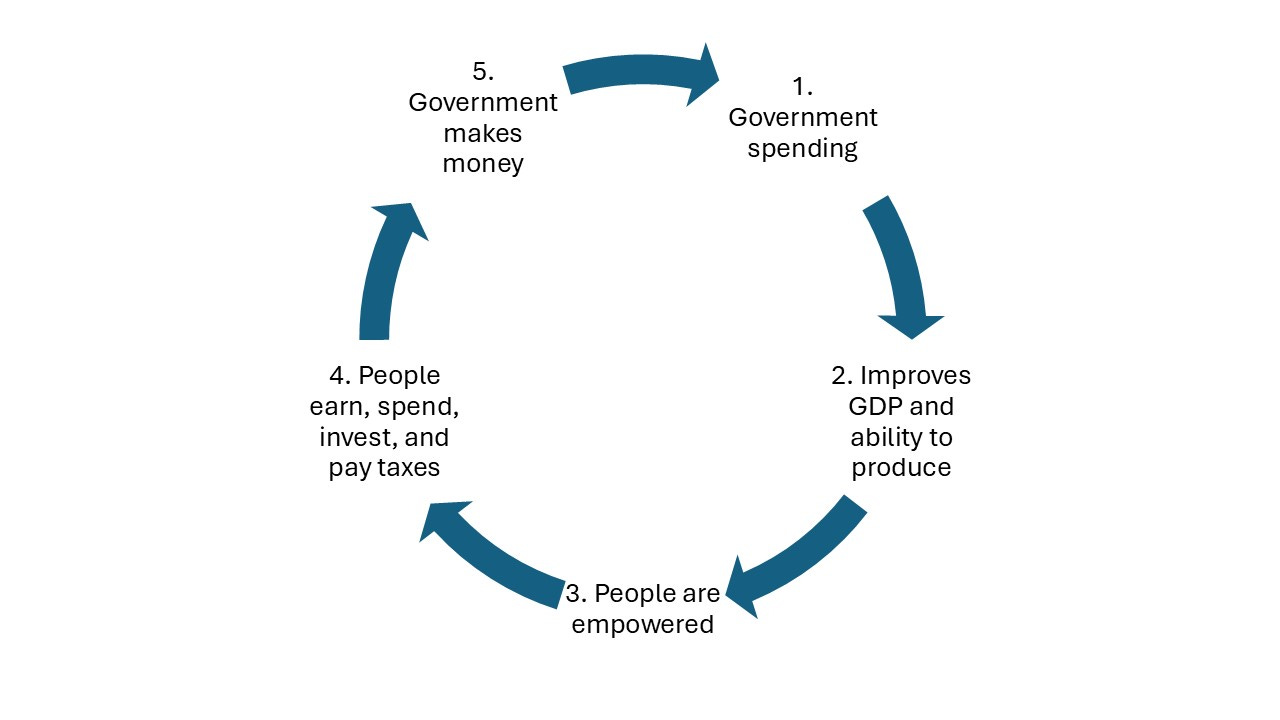

When a government spends money, it creates opportunities for companies or public sector firms by awarding contracts, thereby boosting employment. The outputs of government-issued tenders contribute to national development. For example, if the government invests in healthcare, this can lead to a focus on training healthcare professionals, offering healthcare services at subsidized rates, and expanding healthcare infrastructure. As a result, more individuals gain employment, earn income, spend, invest, and pay taxes, fueling a virtuous cycle of economic growth and improved well-being.

You should understand by now that this is a loop.

In a thriving economy, government expenditure leads to the enhancement of people’s lives and their ability to produce.

So, how do we estimate the efficiency of a government?

A straightforward yet formulaic way to understand government efficiency is by calculating it in the traditional sense:

However, determining the exact values for both Output and Input in this context is challenging.

To address this, we use a simplified metric that measures the change in GDP between two years relative to the government expenditure required to achieve this change. The formula is as follows:

This metric is called the Fiscal Multiplier. The Fiscal Multiplier is a measure of how much each dollar of yearly government spending contributes to year-on-year GDP growth. While this metric provides a rough idea of the relationship between government spending and economic growth, it is a limited and imperfect measure of government efficiency.

This is because government expenditures often yield intangible outcomes that GDP or changes in GDP cannot fully capture. For now, however, this metric serves as a starting point.

Let’s shift our focus to the reasons why a government may become inefficient or imperfect.

5. Understanding classic performance issues (or) What are the routine issues causing poor performance of a government?

So, what makes a government inefficient?

Based on our discussion so far, here are some common issues that contribute to poor government performance, particularly in the context of a nation’s economy:

Low Fiscal Multiplier

A low Fiscal Multiplier indicates that government spending is not significantly impacting GDP. In such cases, the expenditure fails to create substantial economic growth.Excessive Borrowing Without Results

When a government borrows heavily but fails to use the borrowed funds effectively, the GDP does not grow proportionally. This results in an increasing Debt-to-GDP (Debt/GDP) ratio. However, it’s worth noting that this ratio also includes debt accumulated by previous governments, which can make it a slightly misleading metric.Growing Government Deficit

A government deficit measures the difference between the current government’s expenditure and the revenue it generates within a fiscal year. Unlike the Debt/GDP ratio, which includes historical debt, the deficit focuses solely on the current government’s fiscal policy.A growing deficit often indicates flaws in fiscal policy.

While a certain level of deficit is normal, as not all government spending directly generates revenue, a consistently increasing deficit is problematic.

Misalignment Between Government and Public Expectations

This is a frequent issue in underperforming governments. Such governments often focus on minority appeasement, dividing the public into various groups and pitting them against one another. In these cases, the government may prioritize unnecessary expenditures aimed at appeasing specific groups, diverting resources from meaningful development. It is an over emphasis on the intangibles.A Greedy Government

For example, a government may engage in war to profit from arms and ammunition sales or defense contracts. While such actions might boost GDP, they fail to improve the lives of the general population. In this scenario, relying solely on GDP as an indicator would be misleading.Central/Federal-State Misalignment

Case 1: Uncooperative State Government

In a democracy, voters often elect governments of different political ideologies at the federal and state levels. In such cases, state governments may use revenue in ways that conflict with the central/federal government’s priorities, leading to inefficiencies in overall governance.Case 2: Unsupportive Central/Federal Government

Alternatively, when a state government performs well but the central/federal government is unsupportive due to ideological differences, progress in the state may be hindered.

Political Opposition

Political opposition can undermine a government’s efforts for their own gain, misleading the public to secure votes in the next election. This often involves:Sponsoring anti-social elements to create unrest or tarnish the government’s reputation.

Forcing the government to redirect resources toward addressing such issues, wasting funds that could have been used for development.

Misuse of Central Funds by State Governments

In some cases, state governments that differ ideologically from the central government may misuse development funds provided by the center, diverting them for personal or political interests instead of public welfare.Corruption and Hoarding by an Anti-National Government

An anti-national government may hoard public funds and distribute them among corrupt leaders, enriching a select few while the majority remain impoverished.Such governments often exploit the Pareto Principle, allocating only 20% of public funds to win votes while retaining 80% for personal gain.

This corruption may involve funneling money into non-profit organizations (NPOs) or non-government organizations (NGOs) to fund agendas tax-free. Many countries exempt NPOs and NGOs from taxation, making this an attractive option for misappropriating public funds.

Voter's Dilemma:

A recurring issue in many democratic nations is the tendency of voters to change governments every election cycle, often swapping one party for another in hopes of better governance. This cycle, however, often leads to stagnation, as each new government requires time to establish its policies, make structural changes, and foster economic growth. While the incoming administration may inherit revenue and resources, it typically faces delays in executing meaningful reforms, as political and bureaucratic processes take time to implement. As a result, frequent changes in government can prevent long-term planning and investment in key sectors, hindering sustainable progress.

This cycle of change often reflects a lack of trust in the current government's ability to deliver results, yet it fails to acknowledge that real progress requires consistent leadership and strategic vision over an extended period. This dilemma traps the nation in a perpetual state of political instability and economic underperformance, as each new party struggles to address challenges without the continuity necessary for substantial, long-term development.

6. Fixing performance issues (or) How can we resolve the issues discussed?

Awareness

Public awareness and understanding are key. When people become more aware of how the government works, they can better understand where government spending occurs and whether they are receiving value for their contributions.

Transparency

The public must ensure that the government is transparent and accurate about its spending and revenue figures. When people are aware of where the government’s revenue comes from, they can better question its use. For example, in India, according to the last census, Muslims represented 15-17% of the population. However, 96% of taxes in the country are paid by Hindus. This should prompt the public to demand more focus on productivity and accountability. Ultimately, we seek the collective prosperity of the nation. The public deserves to know how the government invests in the welfare of every community and what results come from these investments. When the productivity of a community does not improve despite investments, the issue likely isn’t financial but may be rooted elsewhere. Identifying these root causes allows for targeted solutions instead of relying on handouts.

Predictability

Citizens must recognize that ideological incompatibility between state and central (or federal) governments often leads to inefficiencies and wasted resources. Voting for aligned ideologies between the two levels of government can foster smooth and efficient governance, reducing conflicts and creating predictability where none previously existed.

These three measures—Awareness, Transparency, and Predictability—are more than sufficient to address the issues discussed earlier.

Understanding governance is crucial for the citizens of every country, and I hope this discussion lays a foundation for that understanding.

Finally, revisiting the case of the employee complaining about taxes and the academic complaining about funding: Neither is entirely correct. Funding for academics is a government expenditure, and taxes paid by employees contribute to government revenue. If certain universities and faculty receive funding from the government for research, they are, in effect, receiving taxpayer money. Deciding whether to fund academics requires evaluating how many of these academics can generate inventions, discoveries, or employment in the near future.

In conclusion, understanding the basics of financial governance and government spending is essential for individuals across all fields. Unfortunately, this crucial knowledge is often not adequately emphasized in our education system, leading to a lack of awareness about how financial decisions impact both individuals and the nation. Without this foundation, many people may struggle to grasp the complexities of governance, contributing to inefficiencies and poor decision-making at both personal and societal levels, including voting. Closing this educational gap is essential for empowering individuals to make informed decisions, ultimately enabling governments to achieve sustainable growth and prosperity for all.